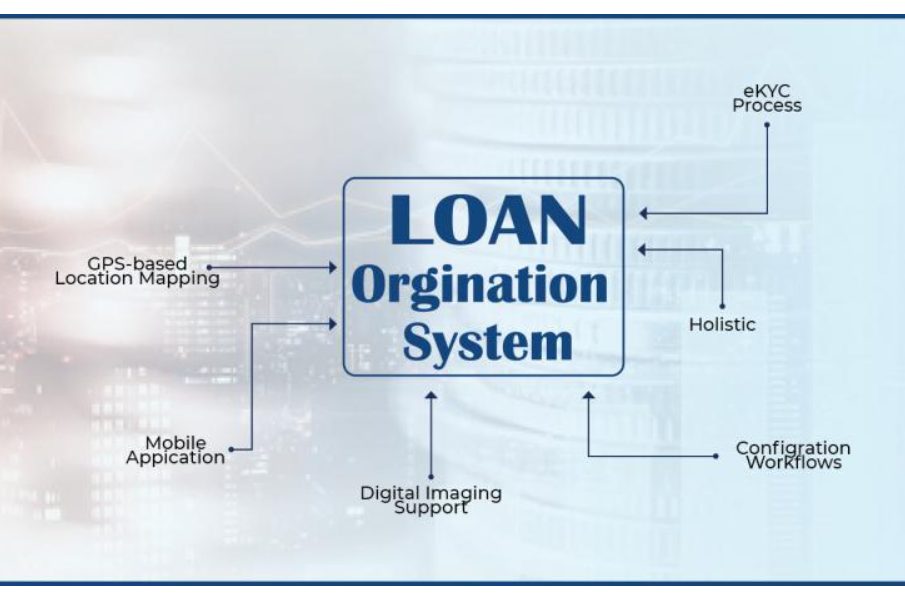

The Shift from Manual to Digital Loan Origination Systems

In 2022, the global market for loan origination systems (LOS) was valued at $4.8 billion. This number is expected to grow significantly, reaching more than $9.5 billion by 2030. This shows a strong average annual growth rate of 10.2% from 2023 to 2032.

Loan origination software is built to make the loan process smoother and more efficient. It automates tasks from the initial application to the final funding of the loan. The system manages the full process, including application, credit review, approval, closing, and disbursement.

The Move from Manual to Digital Systems

In the past, loan origination was a slow and complex process. It relied heavily on paper and manual work, which took up a lot of time. But with the shift to digital systems, loan management has become much quicker, more accurate, and more affordable.

Step-by-Step Process in a Digital LOS:

- Application Submission – Applicants can now fill out and send loan applications online. They can also upload documents and use electronic signatures in a secure way.

- Information Gathering – The system checks the applicant’s creditworthiness by reviewing credit scores, income details, and other financial data.

- Approval or Denial – The software evaluates risk and follows preset rules to approve or reject applications.

- Credit Evaluation – It determines the interest rates, fees, and loan terms based on the applicant’s credit profile and loan choice.

- Closing and Disbursement – The system ensures that the process meets all legal and internal requirements, including disclosures and reports.

- Documentation Management – All documents are stored and organized for easy access and review after the loan process is completed.

Benefits of Using a Digital Loan Origination System

Adopting a digital LOS helps businesses improve their services, stay compliant, and compete better in the market. It brings many tools for automation, reporting, and flexibility.

- Focused on the Customer – Digital systems offer features like self-service portals, real-time updates, and personalized communication. These tools help build strong customer relationships and improve satisfaction.

- Meets Compliance Standards – With the Servosys LOS, lenders can track and report activities easily. This helps reduce penalties and keeps operations in line with industry rules.

- Stronger Competitive Position – By using digital tools to automate decisions and review borrower data, lenders can offer customized loan products and improve overall performance with accurate information.

Why Upgrade from Manual to Digital?

In the banking and finance industry, old manual systems often slow down loan applications. Tasks like checking information, setting terms, and creating paperwork take up a lot of time and staff. Digital LOS platforms can handle these steps faster and more efficiently, helping banks increase the number of applications they can process.

The Servosys low-code platform offers banks a way to build their own custom loan origination systems with little coding. Its easy-to-use design tools make it simple to update systems and add new features.

Digital systems also help reduce mistakes, making the loan process more reliable for both the lender and the borrower. Customers benefit from faster service, while banks enjoy better risk control by spotting and managing possible issues early.

Conclusion

Servosys Loan Origination Systems are designed to meet the specific needs of each business. These systems are flexible and adapt to changes in the market and regulations without interrupting operations. A digital lending platform like this offers speed, flexibility, and a clear advantage in today’s market. With Servosys, banks can handle loan applications more smoothly, thanks to cloud-based systems that improve the experience for both customers and staff.